[ad_1]

The S&P 500 (SPY) continues to bounce round 5,000. Nevertheless, many market commentators are questioning when these massive caps are going handy over the reins to small caps after a 4 yr benefit. Lets do not forget that going again 100 years there’s a clear and determined benefit in smaller shares. Uncover what Steve Reitmeister predicts within the coming yr together with a preview of this high 12 shares to purchase now. Learn on under for extra.

Ought to shares break above 5,000 for S&P 500 (SPY) now?

No…that’s not very logical as the beginning date for Fed charge cuts retains getting pushed additional and additional into the long run. Nevertheless, it is a vital lesson to understand that when you’re in a bull market, it’s best to simply keep invested as you by no means know when the subsequent bull run will happen.

That means that increasingly the proof confirms that market timing is a “fools’ errand“. So, the clever factor to is just keep bullish throughout bull markets.

That does not imply that each inventory will go up. So, let’s spend our time at the moment discussing the shares which have the most effective probability to outperform in 2024.

Market Commentary

This was an fascinating week for the market. After 2 straight classes breaking above 5,000, shares have been despatched reeling on Tuesday’s a lot hotter than anticipated CPI report which pushed out the possible begin date for charge cuts.

The -1.37% decline for the S&P 500 was fairly tough. However much more brutal was the -3.96% slashing of small caps.

This “appeared” to set the stage for a consolidation interval underneath 5,000 and maybe a stiffer 3-5% pullback as traders await a clearer sign to maneuver forward. But on Wednesday traders clearly acquired a case of amnesia as shares closed the session at 5,000.62. After which Thursday pressed additional increased to five,029.73.

If you’d like a story to clarify this, then it could possibly be twisted that the a lot weaker than anticipated Retail Gross sales report on Thursday ought to assist with the inflation drawback. Nevertheless, that does not maintain a lot water when GDPNow estimates nonetheless name for +2.9% progress in Q1.

That may be a contact too sizzling for Fed’s liking. That means these are above pattern progress ranges for the US financial system that deliver it with it extra inflationary pressures.

Little question the Fed would favor a real “mushy touchdown” studying nearer to 1% GDP progress that will include larger moderations of inflationary pressures.

This brings us again to the “animal spirits” a part of investing:

Bull markets shall be bullish…and bear markets shall be bearish.

Nobody is arguing that we’re not in a bull market proper now. So, irrespective of how logical it may appear for the latest inventory advance to simmer down till the timing of Fed charge cuts is clearer…it is usually unwise to wager towards that main bullish pattern.

To sum it up…keep bullish till there are considerations of recession that will enhance the chances of a recession forming.

With that being stated, I’ll keep on with my earlier prognostications for 2024 that there’s not an amazing quantity of upside for the S&P 500 after the large features the previous 17 months from the October 2022 lows. As an alternative, the big caps, and particularly the Magnificent 7 mega caps, that dominate the index are absolutely valued to overvalued by most goal requirements.

I think that 5,250 (about 10% above the 2023 shut) is a beneficiant upside for the market this yr. As an alternative, I foresee the 4 yr benefit for big caps over their smaller friends goes to finish.

This tide began to show through the late 2023 rally. But because the calendar flipped to 2024 traders acquired again to their outdated habits.

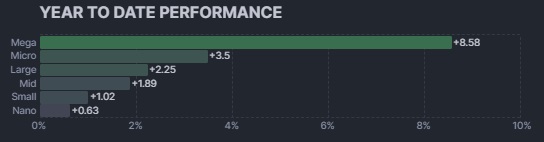

That being a focus within the Magnificent 7 shares that has mega caps pulling approach forward of the pack. That is on clear show within the chart under:

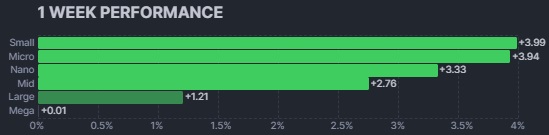

The excellent news is that this previous week small caps are taking the baton to guide the inventory investing race. And sure, Mega caps pressed pause on the identical time.

My intestine continues to consider strongly that this latest pattern has legs. That traders should look farther and wider to search out shares worthy of extra upside.

This can make them small and mid caps which have spectacular progress prospects. The important thing being far more affordable valuations than their massive cap friends. The mix of superior progress + engaging valuation = larger upside potential.

This investing playbook is on the very coronary heart of the best way I’m managing my portfolios this yr. And gladly leans into the power of our POWR Rankings system.

This quantitative system analyzes 5,300 shares by the identical 118 components. That means it may analyze the basic and value motion deserves of Apple and NVIDIA by the identical yardstick it may measure a $500 million market cap “underneath the radar” choice.

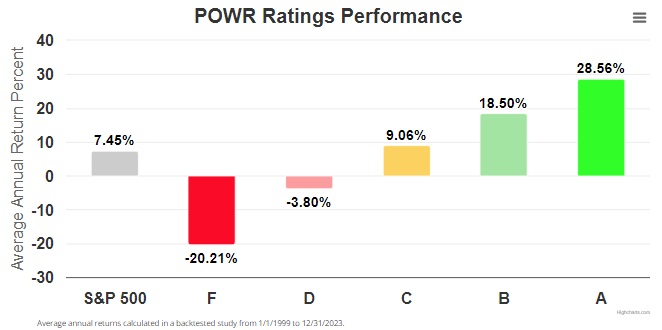

Certainly, it’s that day by day evaluation of 118 various factors for each inventory that finds these with stellar progress and worth traits that factors to future outperformance. And thus, why this POWR Rankings efficiency chart courting again to 1999 speaks for itself:

Which high rated POWR Rankings shares am I deciding on at the moment?

Learn on under for the solutions…

What To Do Subsequent?

Uncover my present portfolio of 12 shares packed to the brim with the outperforming advantages present in our unique POWR Rankings mannequin. (Practically 4X higher than the S&P 500 going again to 1999)

This consists of 5 underneath the radar small caps just lately added with large upside potential.

Plus I’ve 1 particular ETF that’s extremely effectively positioned to outpace the market within the weeks and months forward.

That is all primarily based on my 43 years of investing expertise seeing bull markets…bear markets…and all the things between.

In case you are curious to be taught extra, and wish to see these fortunate 13 hand chosen trades, then please click on the hyperlink under to get began now.

Steve Reitmeister’s Buying and selling Plan & Prime Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Complete Return

SPY shares have been buying and selling at $500.82 per share on Friday morning, down $1.19 (-0.24%). Yr-to-date, SPY has gained 5.37%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Writer: Steve Reitmeister

Steve is healthier identified to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Complete Return portfolio. Be taught extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The submit Are Small Cap Shares Able to Lead? appeared first on StockNews.com

[ad_2]