[ad_1]

Many seasoned traders are getting a bit involved about shares surging to five,100 for the S&P 500 (SPY). That is as a result of earnings progress is sort of non-existent and thus inventory costs are attending to elevated ranges. This might level to a nasty correction forward. That’s the reason it would be best to tune into Steve Reitmeister’s hottest market commentary together with buying and selling plan and prime picks. Learn on beneath for the complete story.

Sure, the frenzy as much as 5,100 for the S&P 500 (SPY) was spectacular. However identical to final 12 months we see far an excessive amount of of the current features flowing in direction of the Magnificent 7 shares. A whole lot of that because of the “off the charts” earnings report from NVDA.

Sadly, the broader we glance…the more durable it’s to really feel uber bullish. Very true with Fed indicators pointing to June being the primary fee minimize (and once more…perhaps even later than that).

This creates an attention-grabbing funding panorama the place shares are in any respect time highs and but earnings progress could be very low. Not an incredible recipe for future inventory market advance.

Let’s dig in deeper on this very important subject on this week’s Reitmeister Complete Return commentary.

Market Commentary

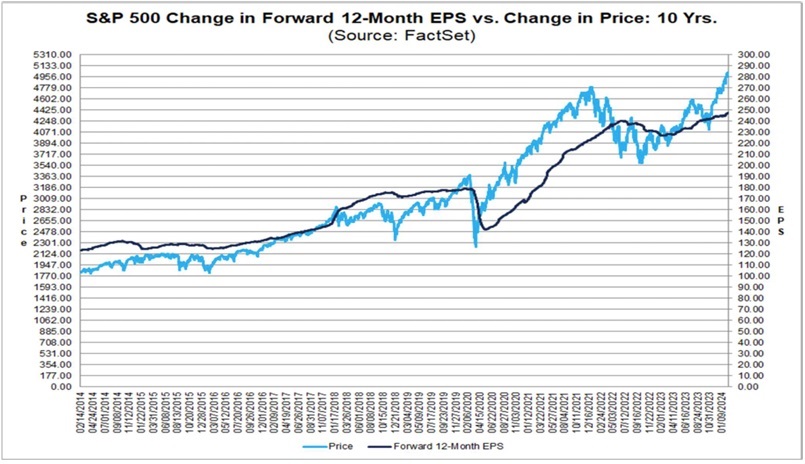

We have to begin the dialog with this provocative chart from FactSet evaluating the motion of the ahead S&P 500 EPS estimates versus the inventory index:

You’ll uncover that for many of the previous 10 years the darkish line for earnings is above the worth motion. That means the development within the earnings outlook propelled shares larger. But every time we discover the inventory index climbing above the EPS outlook it comes again right down to dimension prefer it did in 2022.

So, it’s attention-grabbing to ponder that the current inventory surge beginning in November was borne beneath the auspices that the Fed would quickly be decreasing charges. And but as time rolls on, we discover that’s not true with the beginning date pushed out additional and additional.

Final week’s launch of the FOMC Minutes reaffirmed the hawkish intent of the Fed to not act too early to decrease the charges lest they threat inflation staying above development far too lengthy. This information, on prime of hotter than anticipated CPI inflation #s this previous month, has traders recalculating when the Fed will formally begin reducing charges.

Proper now, the chances of the primary fee minimize taking place on the Could 1st assembly stands at solely 19% all the best way down from 88% probability a month in the past. This has sights despatched extra on June being the beginning line because the market units that likelihood at 63% which is nice, however not overhwelming conviction.

Again to the S&P 500 earnings chart above…I consider that shares are working effectively forward of the basics. If the teachings of historical past maintain true, then it factors to 2 potential outcomes.

First, could be a correction for inventory costs to be extra in keeping with the true state of the earnings outlook. One thing within the vary of 10% ought to do the trick with a number of the extra inflated shares enduring a stiffer 20%+ penalty.

However, shares might stage out for some time patiently ready for charges to be lowered. This act is a well-known catalyst for higher financial progress that ought to lastly push earnings larger getting issues again in equilibrium with the index value.

Sure, there’s a 3rd case the place shares simply maintain rallying as a result of traders aren’t wholly rationale. Sadly, these durations of irrational exuberance led to way more painful corrections additional down the highway. So, let’s hope that won’t be the case right here.

Buying and selling Plan

I consider the twond state of affairs above is the almost definitely. That’s the place the S&P 500 ranges out for some time. Maybe clinging in tight consolidation beneath the current highs of 5,100. Or maybe a wider buying and selling vary right down to the earlier breakout stage of 4,800.

My best hope is that the current rotation to small cap shares continues to unfold. For instance, over the previous three periods the S&P 500 has really slipped just a little from the highs. All of the whereas the small caps within the Russell 2000 have generated a way more spectacular +2.2% achieve…and at last again into constructive territory on the 12 months.

The primary level is that we’re rightfully in a bull market. Simply generally the worth motion will get forward of the basics. So, this both creates a interval of pause…or correction. I sense the previous is the almost definitely state of affairs.

In that setting the general market would not transfer a lot, however overpriced shares are typically squeezed down, whereas worth shares are bid up.

We’ve got an incredible benefit to seek out these greatest worth shares because of the 31 worth elements contained in the POWR Worth mannequin. You and I shouldn’t have sufficient hours within the day to judge these 31 elements by hand for all 5,300 shares measured by the POWR Scores mannequin.

Gladly the computer systems do the heavy lifting for us every evening making it a lot simpler handy choose the shares that finish in our portfolio.

Which of them are in my portfolio now?

Learn on beneath for the reply…

What To Do Subsequent?

Uncover my present portfolio of 12 shares packed to the brim with the outperforming advantages present in our unique POWR Scores mannequin. (Practically 4X higher than the S&P 500 going again to 1999)

This consists of 5 beneath the radar small caps lately added with great upside potential.

Plus I’ve 1 particular ETF that’s extremely effectively positioned to outpace the market within the weeks and months forward.

That is all primarily based on my 43 years of investing expertise seeing bull markets…bear markets…and every little thing between.

If you’re curious to study extra, and wish to see these fortunate 13 hand chosen trades, then please click on the hyperlink beneath to get began now.

Steve Reitmeister’s Buying and selling Plan & Prime Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Complete Return

SPY shares have been buying and selling at $506.93 per share on Tuesday afternoon, up $0.94 (+0.19%). Yr-to-date, SPY has gained 6.65%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Creator: Steve Reitmeister

Steve is best recognized to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Complete Return portfolio. Study extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The publish Does This Chart Level to a Inventory Correction? appeared first on StockNews.com

[ad_2]