[ad_1]

An instance of grabbing beneficial properties from comparative efficiency with a decrease threat China pairs commerce on BIDU/PDD.

One of many most important methods we emply at POWR Choices is named a pairs commerce. We glance to establish conditions whee the a lot larger rated inventory within the POWR Scores has dramatically underperformed the a lot decrease rated inventory. Purchase bullish calls on the upper rated identify and bearish places on the decrease rated firm.

The expecation is that the relative divergence between the 2 shares will probably be start to converge. This implies we count on the higher inventory to begin outperforming the more severe inventory with the bullish calls performing higher than the bearish places.

A current instance of a pairs commerce executed within the POWR Choices portfolio could assist spotlight the technique.

On October 23, POWR Choices noticed that C-rated Pinduoduo inventory (PDD) had as soon as once more begun to outperform the upper B-rated Baidu (BIDU). Each shares have been in the identical industry-Chinese language Web. PDD was ranked at 26 out of 42 whereas BIDU was ranked at quantity 9.

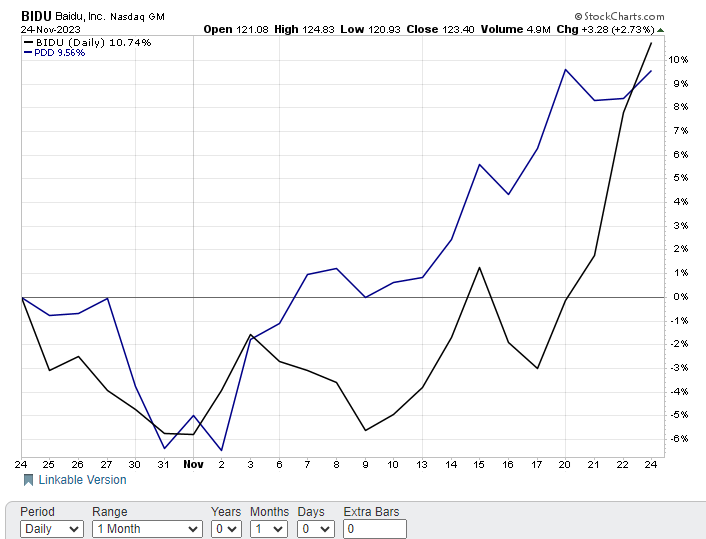

The chart under reveals the comparative efficiency over the previous two years. Usually the 2 shares are typically way more extremely correlated. Expectations have been for BIDU to outperform PDD over the approaching weeks and shut the efficiency hole because it had previously.

The commerce was to purchase January 120 calls on BIDU at $4.50 and January 90 places on PDD for $4.40.

We additionally at all times have a look at implied volatility on each commerce to keep away from shopping for costly choices.

On this occasion, BIDU IV was nicely under common on the 26th percentile whereas PDD places have been even cheaper at solely the 11th percentile. Each the BIDU calls and PDD places have been comparatively low-cost.

The chart under reveals how BIDU has lastly outperformed PDD over the previous month. Achieve of 10.74% for BIDU versus a acquire of 9.56% for PDD.

The magnitude of the beneficial properties is necessary as nicely. Initially the delta on the BIDU calls have been 35 at commerce inception on October 23. The PDD put delta was a -23 delta. Delta represents the inventory equal of the choices. So our intial commerce would have barely bullish at 12 deltas web long-or about 12 shares of inventory.

Quick ahead to November 24 and the BIDU name delta rose to 64 whereas the PDD put delta fell to -7. Now decidedly extra bullish at 57 deltas web lengthy. The commerce construction of shopping for each calls and places advantages from large strikes within the underlying inventory. In essence, we make extra on the calls as each shares rise than what we lose on the places.

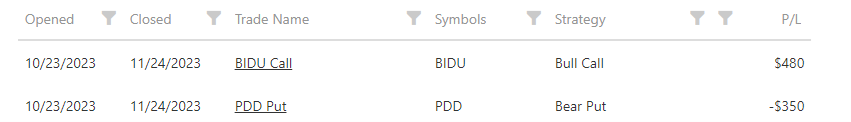

Precise commerce particulars are proven under:

Internet acquire on the commerce was $130- a revenue of $480 on BIDU calls and a lack of $350 on PDD Places. Preliminary value was $890 ($450 for the BIDU calls and $440 for the PDD places).

That places the web share acquire on the pairs commerce at slightly below 15%. The holding interval was a month. Not a foul 30-day acquire on a reasonably impartial place. The 15% month-to-month acquire equates to an annualized acquire of over 400%.

Not each commerce, and even pairs commerce, will work out in the same method to our China pairs.

As now we have mentioned previously (and certain proceed to say sooner or later), buying and selling is all about chance and never certainty.

However for these trying to put the percentages in your favor in a decrease threat approach, you could wish to give the POWR Choices methodology a attempt.

POWR Choices

What To Do Subsequent?

If you happen to’re on the lookout for the most effective choices trades for at the moment’s market, it’s best to try our newest presentation Find out how to Commerce Choices with the POWR Scores. Right here we present you the right way to persistently discover the highest choices trades, whereas minimizing threat.

If that appeals to you, and also you wish to study extra about this highly effective new choices technique, then click on under to get entry to this well timed funding presentation now:

Find out how to Commerce Choices with the POWR Scores

All of the Greatest!

Tim Biggam

Editor, POWR Choices Publication

BIDU shares closed at $123.40 on Friday, up $3.28 (+2.73%). 12 months-to-date, BIDU has gained 7.89%, versus a 20.38% rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Writer: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Commerce Stay”. His overriding ardour is to make the advanced world of choices extra comprehensible and subsequently extra helpful to the on a regular basis dealer.

Tim is the editor of the POWR Choices e-newsletter. Study extra about Tim’s background, together with hyperlinks to his most up-to-date articles.

The submit Find out how to Revenue Utilizing The Probabilistic POWR Pairs Course of appeared first on StockNews.com

[ad_2]