[ad_1]

I like listening to how different folks manage their cash, so right here’s a glimpse into my YNAB price range classes!

This one’s for the Finances Nerds!

This submit will in all probability not attraction to the vast majority of you who don’t use YNAB. However those that do – you’ll like it! This one is for the price range nerds on the market, like me. I LOVE the YNAB Finances Nerds Podcast hosted by Ben and Ernie. Yow will discover it right here on Apple Podcasts, right here on Spotify, and right here on YouTube!

Final fall they aired an episode that includes Lee, who went line-by-line via his price range and shared his class construction together with the whole lot from emojis to why he selected sure class names. I fully geeked out over the episode. A lot in order that I emailed Ben and Ernie and informed them I’d enthusiastically like to be on the podcast to do the identical factor! A lot to my shock, they agreed, and this week we can be recording the episode. I’ll allow you to all know when it’s printed!

What a price range tells you

Whereas a few of you could already be falling asleep at your desk, others of you may be curious what’s so cool about seeing somebody’s price range. What you spend your {dollars} on displays what you worth. Whereas I gained’t be sharing actual numbers (that may be the juiciest, wouldn’t it?!), by sharing my class teams, names, and spending plan, you may get a good suggestion of what I worth most. Furthermore, I’ve STRONG opinions about how I manage my price range. I hope you’ll be able to really feel my pleasure on this matter wafting off the web page!

Our Family Snapshot

In case you might be new right here, right here’s a snapshot of our family to assist perceive our price range:

- Married couple in our 40s

- Two incomes, every small enterprise house owners (I’m a blogger; he’s a normal contractor)

- Two youngsters, ages 11 and 5

- Joint checking with a aspect account for Thomas’s enjoyable cash

- I’m the “cash individual” so I do a lot of the YNABing!

What’s YNAB?

I’ve been utilizing YNAB since I used to be first launched in a sponsored submit alternative in 2016. Right here is my first impression submit and what I discovered after 6 months of utilizing it. I even created our marriage ceremony price range in YNAB, and I take advantage of it for my enterprise bills, too. I completely love that it allows you to divide your cash right into a pie, plan for the long run, and know instantly precisely what cash is put aside for what purpose. When you haven’t tried it earlier than, my hyperlink will get you a free month. I truthfully can not think about life with out it – I really feel that strongly!

How I manage my price range

I like to prepare issues, and organizing our joint checking account isn’t any totally different. Earlier than I begin to undergo my classes, I needed to take a minute to speak about how I manage my price range. I’ve listened to others discuss their class teams (on podcasts, YouTube, and many others.) and I’ve tried a variety of totally different methods: no teams (one lengthy alphabetical record), teams by matter (meals, youngsters, pets), and teams by transaction kind or date.

Finally, I like mirroring Ramit Sethi’s pointers in his acutely aware spending plan divided into: fastened prices, brief time period financial savings, guilt-free spending, and investing. These 4 buckets as percentages are an ideal guideline to comply with for a strong monetary place, and I like understanding the quantity we spend in every group off the highest of my head. Mix my month-to-month and annual bills collectively for fastened prices after which add financial savings and journey collectively for short-term financial savings.

My Class Teams:

- Financial savings (on the very high, to encourage progress!)

- Spending (all needs)

- Month-to-month Bills (wants, goes to zero every month)

- Annual Bills (wants, carries a stability every month, has a goal)

- Journey (all needs however wants its personal group on account of excessive price when used)

- Adulting (holding / reporting classes that hardly ever get cash assigned)

Typically these go down the web page from most to least used / vital:

- Financial savings will get the highest spot as a result of I wish to really feel essentially the most motivated by it rising! I additionally assume the psychology of seeing it most frequently jogs my memory of my targets once I open my price range to spend.

- The Spending group is close to the highest for straightforward entry as a result of it’s the one I entry and spend from essentially the most.

- The Month-to-month Bills group is usually automated, however I do examine to ensure transactions are popping out and the balances are going to $0.

- The Annual Bills group will get the least motion as a result of these are lumpy / true bills which are sinking funds for issues which are essential and anticipated however as soon as or a number of instances a yr bills. I examine this part the least of the 4 talked about.

- Journey is close to the underside, but it surely will get pinned to the highest if we’re on a visit. Technically, that is a part of the short-term financial savings group, however I like to tug it out as a result of it’s so discretionary in comparison with money reserves.

- And the Adulting group is admittedly only a solution to monitor cash that flows via my price range for taxes, investing, or reimbursements.

Emojis

Within the YNAB world, there are some robust opinions about the place the emojis go! I’ve to have mine on the finish of the road. I’ve tried the start and hated it as a result of it took my eye too lengthy to seek out the phrase to learn. However I do love having the colour and image of an emoji there, so I’ve them on virtually all of my classes. The emoji is strategically chosen, in fact 🙂

My YNAB Finances Classes

So let’s undergo every class group and see how the pie is cut up up!

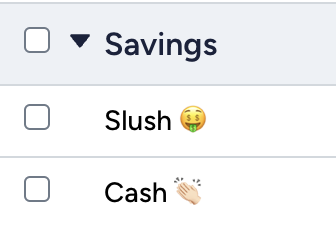

Financial savings

The Financial savings class group is on the very high of my price range to be a relentless reminder of a very powerful factor: saving extra! There are two foremost buckets right here:

- Slush is the underside of my checking account. I preserve a base amount of money right here as a buffer in order that we’re by no means getting near $0 if all payments are paid on the identical day. I additionally use this Slush to cowl overspending after which high it again off the next month. I like for it to be a good complete quantity at the start of the month so I’m much less tempted to take from it. That forces me to whack-a-mole (WAM) different classes earlier than taking from the slush.

- Money is our emergency fund – aka money reserves. I used to have it labeled emergency fund however seeing the phrase “emergency” on the high of my price range was alarming, so I modified it to money which has a pleasant cozy and secure really feel! The purpose for the Money line is for it to develop and for additional to get skimmed off the highest for non-retirement investments or enjoyable spending, like a visit.

This money reserves are held in a 5% high-interest financial savings account. Whereas I’m very comfortable to be incomes curiosity on this cash, having a separate account to switch out and in of goes towards the simplicity I attempt to combat for.

Our retirement investments come out of our paychecks / companies, so I don’t have a line merchandise for these on the high, however I DO filter a few of them via our joint checking account as transfers (from my enterprise to my Solo 401k account or funding account) so I’ve a line in Adulting for Retirement for monitoring functions. See extra on that beneath!

Spending

Desires vs. Wants

Now the enjoyable stuff: Spending! I discussed above that my class teams are balanced between “needs” and “wants” as a result of I like to have the ability to know off the highest of my head what greenback quantity we spend monthly is discretionary. This helps me have an thought of what our baseline fastened bills are and what we may reduce out if we wanted to. I’m consistently combating the stability of simplicity and information. I’ve experimented with breaking our spending into sub teams and that simply sophisticated issues. All I actually need to know right here is that this complete group is discretionary!

The place is Thomas?

You would possibly assume that my husband has no enjoyable cash. Quite the opposite! He has a private checking account that will get funded every month straight from his paycheck. Since he’s not within the weeds of the price range daily like I’m, it really works out completely for him to have his personal place to play. I by no means should see his transactions, which is nice as a result of I’d in all probability query all of them! Haha. He pays for haircuts, golf, presents, lunches out, and toys along with his account.

Assigning Cash

This class group has essentially the most variation month to month. Generally I don’t even fund a line (like Spa – that one will get the least consideration!). There’s additionally essentially the most WAM occurring between these classes, stealing from eating out to purchase one thing, or most frequently not shopping for one thing as a result of we dined out an excessive amount of! I really feel strongly that these classes go to zero on the finish of the month in order that I can refund them the subsequent month and preserve our assigned cash even. My purpose is all the time to have one thing left to roll into financial savings, however that doesn’t occur a lot.

Eating Out

At one level I attempted to divide up Eating Out into: Kath lunches, date nights, household meals, and bars and it was simply an excessive amount of dividing! I needed the info, however I didn’t wish to should micromanage the classes, so I ended up rolling the whole lot again into an enormous Eating Out class.

Household Spending vs. Actions

Household Spending consists of purchases that profit us as a pair that aren’t essential purchases. Frivolous issues. Consumable issues like a brand new NA wine to strive. Tickets to live shows that we go to collectively, and many others. Actions, however, are family-friendly enjoyable issues we do with the children. Films. Ice cream (it’s extra of an exercise than a meals!). The trampoline park. And so on.

Presents

Lastly, Presents is our giving class. We sponsor a household via Holt Worldwide and that may be a common expense. After which there are birthday/marriage ceremony/child bathe presents. After which there are giving alternatives wish to help folks’s causes. That each one goes underneath this class. The 2 present varieties that don’t go underneath listed below are Birthdays and Christmas – these are annual bills beneath!

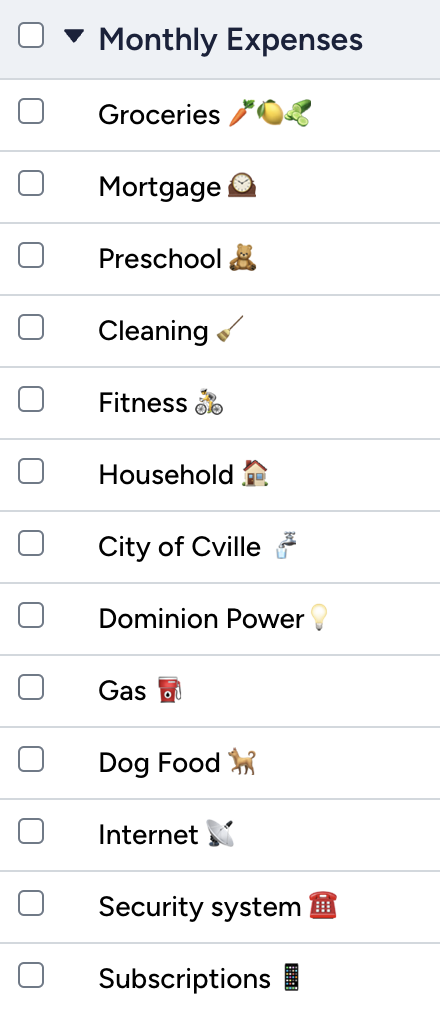

Month-to-month Bills

The Month-to-month bills group is about as boring as they arrive. The “massive three” are on the high – Groceries, Mortgage, Preschool. We solely have a number of extra months of paying for preschool, and that can be such an enormous celebration for the price range! These classes get funded fairly evenly month to month, and each class needs to be zero on the finish of the month. That’s how I can control what payments have been auto-drafted since most of those are auto-drafted. The one class that’s considerably flex in right here is Family, which is the place I put all 100% essential home purchases, like rest room paper or laundry detergent. I’ve debated placing these with Groceries, however I do like holding the meals separate.

I’ve Health and Cleansing on this class which you’ll assume are “needs” not “wants” however they’re right here as a result of they’re the final issues we’d let go of in an emergency life scenario. Health covers our fitness center membership and Peloton which is totally different from the Sports activities class in annual bills beneath.

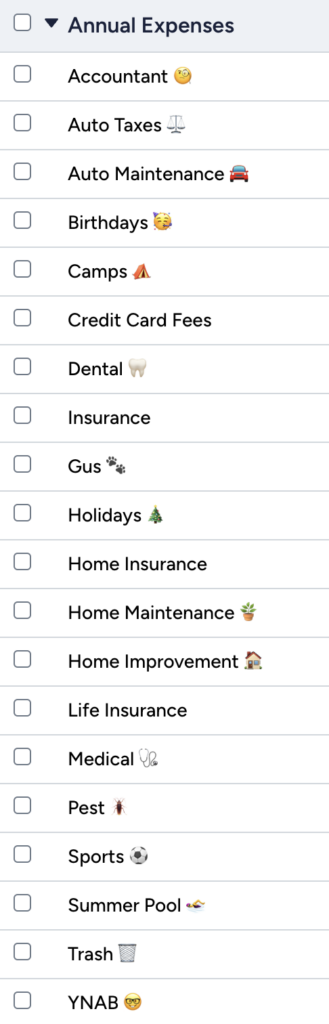

Annual Bills

This class consists of all of the shock bills that shouldn’t actually be surprises! YNAB calls these lumpy, typically annual bills, “True Bills.” They’re sinking funds to pay for issues that you understand are coming (Insurance coverage each August! Christmas each December!). These are a mixture of needs and desires, however I’d say they lean on the wants aspect, so I take into account them a part of my fastened bills.

Life is Lumpy

On Select FI, Brad likes to say “life is lumpy.” My purpose is life is a clean price range with no lumps! Whereas in fact there can be some sudden bills alongside the way in which, if I can plan for it, I need to plan for it. We pay our accountant, auto taxes, bank card annual charges, insurance coverage, vet payments, pest management, summer season pool, trash and YNAB (!!) a couple of times a yr. I used to hate it when a “lumpy month” occurred. However since falling in love with YNAB, I’ve prorated the whole lot! These classes all have a YNAB Goal set so I simply click on one button to fund 1/12 of the quantity I want every month.

Birthdays and Holidays

Extra not too long ago I turned these into Annual Bills. Save $100 a month for 12 months and you’ve got the money for your entire vacation giving. The identical for our birthday season (This fall!).

Dental and Medical

I’m not a kind of individuals who retains their complete household deductible sitting in my medical price range. I normally see what appointments we’ve got developing and put some {dollars} in the direction of them, plus one additional go to if somebody was sick. If we have been to have an ER go to or larger expense, I’d use my money reserves (emergency fund) after which work to replenish that after. For dental, I take the 4 of us and the price of our appointments and add them up, after which divide by 12.

Gus The Canine

I’ve the predictable pet food within the Month-to-month class, so this line is for something lumpy that Gus wants – his annual vet payments, flea medication, and a pair of weeks a yr of canine sitting once we journey.

Sports activities

I preserve sports activities and health separate due to the children’ sports activities. The health class in month-to-month is our fitness center and Peloton. We’ve got no intention of ever cancelling them. However this sports activities class covers registration charges for two adults of yr spherical soccer. After which the children charges are in there as effectively for spring and fall.

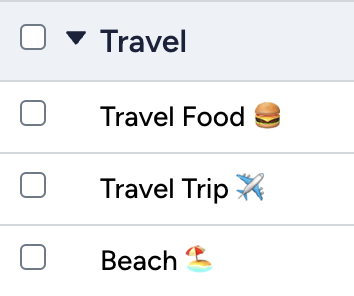

Journey

This might simply be grouped into Financial savings or Annual Bills and even the Spending group, however it’s separate as a result of it’s the one space the place I do wish to have some additional reporting and it tends to be tremendous lumpy! We don’t journey each month, so I don’t need it cluttering the highest of the price range OR combined into the “wants” part as a result of journey is 100% a need. Thus, it will get its personal space. I’ve experimented with budgeting a month-to-month quantity to this class, but when we don’t have a visit deliberate, then I find yourself simply WAMing that cash elsewhere. So I don’t price range to this class till we’ve got a visit deliberate (normally at the very least a number of months out).

Additionally as a result of we use bank card rewards for many of our base journey, the journey class isn’t as baller as it will be if we used all money! We’re largely budgeting for meals on journeys and a few incidentals for the journey half (airport parking, and many others.) in order that’s why I separated out meals and journey.

Lastly, we do normally take a household seashore journey each summer season that may be a predictable, common quantity that I prorate all yr, in order that seashore journey will get its personal class. I wish to know that I can spend the journey journey to zero if I’m on one other journey and by no means wish to be doing psychological math to subtract out funds reserved. Seaside has been within the Annual Bills group earlier than, but it surely moved underneath Journey once I determined to get higher about experiences.

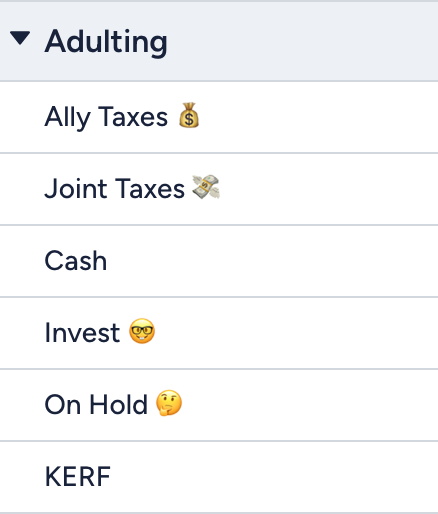

Adulting

Consider the Adulting class as a reporting / switch group greater than a gaggle the place I assign cash every month.

- Ally + Joint Taxes: The 2 taxes traces are for holding and paying estimated quarterly taxes for my enterprise. The identify signifies which account they’re in (I transfer them forwards and backwards from the Ally account as a result of that’s the 5% curiosity account! Generally I miss simply having one account at zero curiosity, hahaha).

- Money is money out of the ATM, which I hardly ever get. If I do, it’s typically for a babysitter or a present, so it goes in that class. This money line is usually if I simply randomly get some out however don’t know the way I’ll spend it.

- Make investments is an apparent one – it’s any cash we ship to the funding account.

- On Maintain is a line merchandise for reimbursements. Just a few years in the past I used to be answerable for paying for the household seashore home and my fam venmoed me giant sums of cash. I didn’t need it to combine with mine, so it parked it in right here.

- KERF is a line merchandise in case a KERF expense runs via the non-public price range. It occurs.

Focus Teams

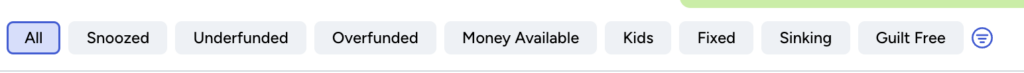

YNAB has a new-ish function referred to as Focus Teams, and they’re superior as a result of they help you group classes collectively that you just might need in a special group construction in your price range. I created a few of my very own:

- Youngsters bills – pulled from all totally different teams

- Mounted – combines month-to-month and annual bills

- Sinking Funds – all financial savings accounts with no clear expense timeline (aka Birthdays, Christmas, Automobile Upkeep)

- Guilt Free – pulls all of the spending from all of the classes regardless of the assigned group

I like those YNAB has auto-populated too!

There you might have it!

When you made it to the top of this submit, nice job! You should be an enormous nerd like me!

If in case you have questions on my classes, budgeting usually, or have robust opinions about why your construction is the most effective, please write a remark!

Extra Monetary Weblog Posts:

[ad_2]